Global banking giants are increasing their investments in new crypto and blockchain companies. According to a new study by Blockdata, which provides data on the blockchain market, 55 of the world’s 100 largest banks in terms of AUM (assets under management) have now entered the cryptocurrency and blockchain market to varying degrees. According to this report, banks and their subsidiaries have invested in cryptocurrency and decentralized ledger technology companies, sometimes directly and sometimes indirectly. Also, they are interested in the best-paid crypto signals by famous persons.

- Blockdata shows that the banks that provide the most support to blockchain and crypto companies are Barclays, Citigroup, and Goldman Sachs. JPMorgan and BNP have made a number of investments in this area.

- These investments are part of a trend to support larger blockchain companies. Funds provided to cryptocurrency companies have doubled since 2020, according to a KPMG report.

The crypto area in which banks are most interested

The study also reveals which cryptocurrency banks are the most interesting. Banks pay more attention to the storage of cryptocurrency. Indeed, a quarter of the top 100 banks either develop their own cryptocurrency storage services or support digital asset storage companies.

SafeTrading previously reported that a number of banks in the US, Asia, and Europe are developing their own platforms for storing cryptocurrencies. These banks are entering the cryptocurrency industry from this area.

There are also three different things – why such services invest in the crypto sphere. These:

- Rapidly growing revenues of crypto organizations.

- Normative achievements.

- Increased demand for crypto assets among bank customers.

NYDIG Chairman Yang Zhao said in May that the surge in revenue from cryptocurrency trading giants such as Coinbase prompted banks to rethink their strategies. Because these crypto organizations can generate more revenue by working with small teams – experts of SafeTrading.

ADA Becomes The Best Altcoin in the top 50!

Cardano (ADA), one of the most popular cryptocurrencies, hit its highest level in 12 weeks at $1.99 for the day. On the weekly timeframe, the ADA is up less than 20% from an all-time high of $2.45 on May 16, after rising 42% by best-paid crypto signals.

↑ Cardano (ADA)

According to Coinmarketcap data, Cardano has managed to become the most efficient altcoin in the top 50 cryptocurrencies. Ranked # 3 by market value, Binance Coin (BNB) could face the ADA threat. ADA claims third place.

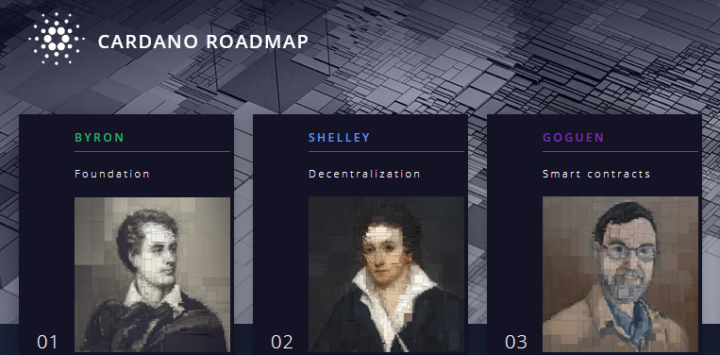

Cardano’s agenda is pretty busy. Opening up new opportunities in Japan as a recent development, ADA has achieved significant success, gaining approval in a region where listing conditions are very difficult. However, Cardano’s rise is unlikely to surprise those following the IOHK agenda.

- According to the daily chart, the ADA continues to rise. Exceeding $ 2 can push the price up to a new all-time high. MACD confirms the bullish tone, while the RSI remains in the overbought zone.

- ADA investors have witnessed that the price of the popular cryptocurrency did not fall below $ 1 even on days when the market was in a downtrend. Having built a strong $ 1 fort, the ADA did not lose its momentum with the area’s defense and built a solid wall for the uptrend.

↑ Bracket Ethereum

IOHK founder Charles Hoskinson also joined the Bitcoin vs Ethereum discussion that was fueled by Twitter CEO Jack Dorsey’s stubborn rejection of the second most popular cryptocurrency, Ethereum. In his response to crypto evangelist Anthony Pompliano, the creator of Cardano congratulated his opponent, stating that Ethereum is better than Bitcoin.

Last month, Charles Hoskinson, in an interview with Lex Friedman, described Bitcoin as “an extinct football star, far from its original form.” Jack Dorsey drew backlash from the Ethereum community yesterday by posting a screenshot of a tweet describing the project as a scam. This share came after the famous Ethereum developer stated that the second-largest blockchain is the true embodiment of Satoshi Nakamoto’s vision.

Coinbase is making new changes to USD Coin.

The stable coin – USD Coin (USDC), developed by Circle Internet Financial and backed by cryptocurrency exchange Coinbase, has lost one of its biggest advantages over its main competitor, USDT.

The popular cryptocurrency exchange Coinbase, which has an important place in the cryptocurrency industry, has made significant changes to its US dollar coins page. Coinbase made changes to the USD Coin website following an audit that showed the popular USDC stablecoin’s reserves were not fully held in cash.

After the last change, when Coinbase users visit the USDC website, they are confronted with a message that they are fully backed by reserve assets.

In addition, the recently added disclosure on the website states that each US dollar is backed by one dollar or an equivalent asset at fair value. It also states that reserves are held in accounts with US-regulated financial institutions.

The popular cryptocurrency exchange Coinbase has made the following announcements, as amended by USDC on its website:

“Fully provided with reserve assets. Each US dollar is backed by an asset with a fair value of US $1 or the equivalent. These assets are held in accounts with financial institutions regulated by the US government. ”

↑ Tether (USDT) and USD Coin (USDC).

- USD Coin is known as the second-largest stablecoin after Tether (USDT). The popular stablecoin is ranked 8th among the largest cryptocurrencies with a market cap of $28 billion. In addition, the latest consolidated inventory report shows that the market cap of Tether (USDT), the largest stablecoin by market cap, is around $63 billion.

- USD Coin (USDC) has traded as a stablecoin fully backed by the US dollar since its launch, making it the second most valuable stablecoin by market capitalization. However, Tether, USDC’s biggest competitor, has had a lot of problems with regulators.

On the other hand, an audit by Grant Horton, a multinational tax consulting company, found that only 61% of USDC reserves were in cash and cash equivalents, and 9% in commercial paper – analyst of SafeTrading.