The human species is one that evolves over time. We’re always looking for ways to make our lives easier and more efficient, which applies to our money as well. For centuries, we’re used to carrying cash in our wallets and pockets. The feel and sound of our bills rustling with our coins is a familiar feeling. Then, we decided to take our payments digitally—spawning online bank transfers, online wallet services, and more. But is that the last step of evolution? Where is our money headed next?

The human species is one that evolves over time. We’re always looking for ways to make our lives easier and more efficient, which applies to our money as well. For centuries, we’re used to carrying cash in our wallets and pockets. The feel and sound of our bills rustling with our coins is a familiar feeling. Then, we decided to take our payments digitally—spawning online bank transfers, online wallet services, and more. But is that the last step of evolution? Where is our money headed next?

That’s right—the Internet. We believe that cryptocurrencies like Bitcoin are going to play a significant role in the way our finances evolve. But what is Bitcoin and how can cryptocurrencies transform our money?

Cryptocurrencies and how they work

In its simplest form, cryptocurrency is “Internet money.” They’re a new and unique form of payment we can use to pay for online goods and services. Unlike bills and coins that we can find on the ground or in between our couch cushions, cryptocurrencies have no physical form. Think of them as online gaming tokens—you’ll first need to convert your local currency to use their crypto counterparts.

The word “cryptocurrency” is derived from the techniques used to encrypt and secure the network. This network, otherwise known as the blockchain (more on this later), uses cryptographic techniques and encryption algorithms to protect the online ledger from being manipulated or tampered with. It also prevents double-spending, an issue that has been a bane of many online currencies’ existence.

Bitcoin (BTC) is clearly the most well-known cryptocurrency on the planet. Introduced in 2009 by an individual or group of individuals (at this point, we’re still not sure of the true identity) named Satoshi Nakamoto, Bitcoin is credited with being the first-ever blockchain-based cryptocurrency.

Since then, Bitcoin has acted as a catalyst for the thousands (and counting) of cryptocurrencies that spawned after. The post-Bitcoin cryptocurrencies, often referred to as “altcoins” or “alternative coins,” include Litecoin (LTC), Ripple (XRP), Ethereum (ETH), and many more.

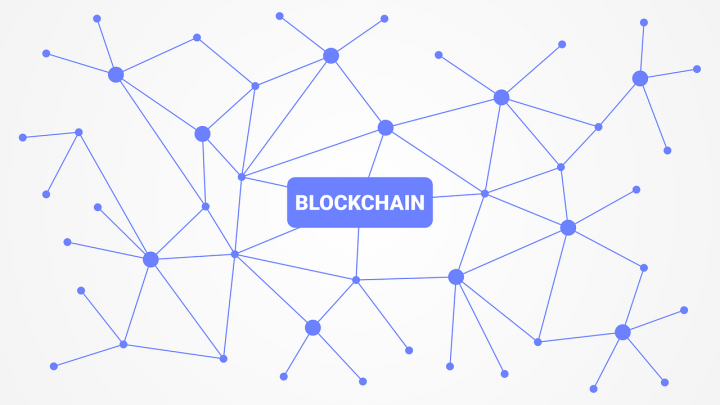

The power of the blockchain

Blockchain is the technology that runs most of the cryptocurrencies on the market. It’s a decentralized technology that uses nodes (computers across the network) to manage and record transactions—effectively securing any transfer on the chain.

Transactions are verified, put into blocks (clumps of transactions), and chained together—forming an online ledger that is immutable and transparent.

The blockchain, a real innovation, is beginning to plant its seeds into many industries. Its potential for streamlining online payment processing is bound to make waves in industries like media, travel, medical, music, and more.

Things you can do with cryptocurrencies

Here are some of the coolest things you can do with cryptocurrencies in 2020 and beyond:

Investing

Cryptocurrencies easily have the most volatile markets out there. Remember when Bitcoin almost hit the 20,000 USD mark in late 2017 and then saw a considerable dip just a couple of months later? Yeah, it’s that volatile. That volatility is precisely why investors are so drawn to this market.

Some investors have no interest in the long-term acceptance of virtual assets and their applications in society. Instead, they care about profiting from the volatile market. Although there’s nothing wrong with that way of thinking, it’s crucial to believe that crypto is more than that—which is why you have to consider its other uses such as…

Buying goods and services

Years ago, it would have been challenging to find crypto-friendly retailers and merchants. It was still a niche way of payment and not a lot of businesses considered accepting it.

However, we now live in a different time. With more merchants beginning to see the benefits of accepting crypto, it’s much easier to find them now. Many merchants, both online and offline, would gladly take your crypto for their goods and services. These range from huge retailers to local bars, restaurants, and coffee shops. You can even avail yourself of travel services and hotels. If you’re feeling a little more lavish than usual, some stores could sell you luxury items like cars and trips to outer space.

With these stores, Bitcoin is usually the go-to currency. Unfortunately, other cryptos like Ethereum, Ripple, and Litecoin aren’t as widely accepted just yet, but you can always convert your altcoins into Bitcoin and spend them that way. Otherwise, we’ll have to wait for these merchants to catch up.

Accepting it as a payment method for your business

On the other end, you could start accepting crypto for your goods and services. It’ll widen your reach and bring you new kinds of customers. It could showcase your business as one that’s innovative and forward-thinking.

To start, all you need is a small sign by your cash register or a banner on your online store. From there, you can send your wallet address or use payment services like hardware terminals, payment intermediaries, or mobile applications to secure the payment.

Where to buy and store cryptocurrencies

When it comes to buying crypto, there are a ton of options you can choose from. There are over a thousand Bitcoin ATMs spread across the world and a ton of online exchanges and marketplaces that allow you to buy virtual currencies with gift cards, bank transfers, and many more.

Cryptocurrencies are stored in digital wallets. There are tons of storage options out there, depending on your trading style. For example, Bitcoin paper wallets are perfect for long-time HODLers and people who don’t want to store their private keys online. There are hardware wallets that can hold multiple cryptos offline in a physical device. There are also mobile wallets for traders who travel a lot. Determine what kind of trading style you have, and then choose the appropriate wallet.

Why cryptocurrencies are rising in popularity

What is causing this surge in the popularity of cryptocurrencies? There are three main reasons:

What is causing this surge in the popularity of cryptocurrencies? There are three main reasons:

- Crypto is the future: Many people believe that cryptocurrencies are the future of payment and they’re racing to buy them now before they become more valuable in the future.

- Crypto puts control into the holder’s hands: Because most cryptocurrencies are decentralized and take central banks out of the equation, these virtual currencies provide a way for people to have real control over their finances. They act as a financial passport that can allow anybody to transact without the restricting limitations that traditional financial institutions impose.

- Crypto brings powerful blockchain technology alongside it: With blockchain already making its way into several industries in society, people believe that it can provide a more secure way to pay and fix the underlying issues of today’s enterprises.

As a result of this rising popularity, altcoins have surged to the upper echelon. Here are the top ten cryptocurrencies on the market:

| # | Name | Price (USD) | Market Cap (USD) | Circulating Supply |

| 1 | Bitcoin (BTC) | 10,744.56 | 198,803,659,968 | 18,502,725 |

| 2 | Ethereum (ETH) | 355.75 | 40,127,011,463 | 112,794,472 |

| 3 | Tether (USDT) | 1.00 | 15,400,594,282 | 15,388,139,837 |

| 4 | Ripple (XRP) | 0.243250 | 10,979,361,198 | 45,136,163,236 |

| 5 | Bitcoin Cash (BCH) | 226.95 | 4,205,578,141 | 18,530,750 |

| 6 | Binance Coin (BNB) | 27.64 | 3,991,584,245 | 144,406,560 |

| 7 | Polkadot (DOT) | 4.51 | 3,842,146,609 | 852,647,705 |

| 8 | Chainlink (LINK) | 10.19 | 3,565,583,768 | 350,000,000 |

| 9 | Cardano (ADA) | 0.102796 | 3,198,247,549 | 31,112,484,646 |

| 10 | Bitcoin SV (BSV) | 168.31 | 3,118,685,802 | 18,528,890 |

*Data as of September 29, 2020, via CoinMarketCap

Advantages and disadvantages of cryptocurrency

Here are some of the notable merits and demerits of cryptocurrency:

Advantages

- Inflation-proof: – Protect your fiat currency from devaluing by converting it into crypto.

- Secure and private: – Blockchain allows cryptocurrencies to have the most secured transactions, making it difficult for anyone to decode and hack. Despite it being a transparent public ledger, identities on the blockchain use pseudonyms to remain private.

- Exchanges are quick and easy: – You can buy cryptos with major currencies like the US dollar, Japanese yen, and the European euro. Browse through thousands of offers on the Internet, choose the best one for you, and get your crypto in minutes.

- Efficient cross-border payments: – With crypto, there’s no need for third-party services to help you make cross-border payments. Transactions are lightning-fast and cheaper since they don’t go through any third parties.

Disadvantages

- Not so environment-friendly: – Cryptocurrency mining requires a lot of electricity to be effective, especially with Bitcoin. The high-intensive nature of mining can easily increase your carbon footprint.

- Losing data access is detrimental to your money: – If you lose the private key to your digital wallet (whether you forgot it or your device is stolen or damaged), you can lose access to your funds—forever.

- No cancellation or refund policy: – If you have a transaction dispute or if you accidentally send funds to the wrong address, there’s no way of getting it back since crypto transactions are irreversible. You can only hope that the person you sent it to is honest enough to send it back.

The legality of cryptocurrency

With the rising popularity of cryptocurrency, there is one question that begins to pop up in everyone’s mind: is it legal?

When Bitcoin was created in 2009, a new paradigm was built alongside it. It was a decentralized and self-sustaining digital currency that took the bigger financial institutions out of the picture, which was bound to cause an uproar among regulators and governing authorities.

The main concern was that cryptocurrency’s pseudo-anonymous nature would lead to the trade of illegal goods and services. Additionally, they were concerned about money laundering and tax evasion.

As cryptocurrencies developed over the years, a lot of these issues have been addressed. It’s much safer now and with “know your customer” (KYC) and “anti-money laundering” (AML) rules now being implemented, illicit activities have been somewhat contained.

However, the legality of cryptocurrency will mostly depend on where you are in the world. Some countries are more welcoming to this new virtual currency than others, so be sure to check your country’s view before diving in.

Cryptocurrencies are here to stay

Although cryptocurrencies have a long way to go before they hit the mainstream, they are continually maturing and developing. It’s only a matter of time before everyone realizes the benefits they can bring.

Right now, the best we can do is to learn as much as we can and spread the good news.

The 5 Great Facts You Need to Know About Crypto Transactions

As already explained, Cryptocurrencies are a fresh market and have a huge potential for new technology. It is still an undiscovered world full of secrets, but it is worth getting acquainted with it, because soon it may be the financial future. Here are a few important things about cryptocurrencies and related transactions.

Transactions using Bitcoin

No transaction that’s completed with Bitcoin can be reversed, it can only be returned or sent back by the person who received the funds. This means that you should pay attention to only doing Bitcoin business or transactions with people or organizations you know and trust, or with an established reputation.

For their part, companies must control the payment requests they submit to customers. Bitcoin can detect typos and usually won’t let you mistakenly send money to the wrong address. Additional services may in the future offer more choice and protection for the consumer. If you want to read about other transactions and learn what swaps are, this article is for you.

What is Blockchain?

Unlike the banking register, Blockchain is publicly available to anyone who uses cryptocurrency that operates on it. It is also maintained and controlled by every user on the network, not by the central site.

The technique of saving blockchain transactions is a bit like writing your money to someone in a notebook – only you are responsible for keeping your registry. Blockchain also combines various transactions of different users in chronological order, which means that once the transaction is completed, they cannot be changed, because it would affect neighboring transactions and any transactions that would be saved after the changed one.

This could easily lead to a network crash.

Blockchain was created so that Bitcoin could exist in a structure without a central center that would monitor and approve transactions, as well as to prevent the so-called double-spending.

Double spending is a scam in which the user spends the same money twice. Blockchain easily prevents this.

What is Bitcoin Halving?

Two halvings have taken place so far in Bitcoin history. The first took place in November 2012, and the second in July 2016. They are inseparable from the very “nature” of cryptocurrency. Bitcoin is a decentralized currency, without the participation and supervision of any top-down authorities (banks or countries).

It is “miners” on computers located around the globe, adding more blocks of information about the compliance of Bitcoin transactions to the so-called public book – the main Bitcoin database. They are rewarded with bitcoins for their time, effort, and costs.

The maximum amount of bitcoins that can be “excavated” is 21,000,000. Once it has been reached, they will not be able to be further produced. To slow down this extraction, the miners ‘coins’ must be reduced, and halving is done for this purpose

Halving automatically follows the overall extraction of 210,000 cryptocurrency blocks by Bitcoin miners.

At this time, the reward for entering the next block calculations by miners is reduced by half. In 2012, it went from 50 to 25 bitcoins, in 2016 25 to 12.5, and the latest, this year’s halving will reduce the price to 6.25 bitcoins. The result of this operation will be a reduction in cryptocurrency inflation to 1.8%, and the daily number of mined units will shrink from 1,800 to just 900.

Thanks to this, the final level of extraction of all bitcoins will be significantly slowed down and will not be reached until 2140. Bitcoin will not lose its value completely, and trading and investing will remain profitable.

Is Cryptocurrency Safe?

Some effort is required to protect your privacy in Bitcoin. All Bitcoin transactions are stored permanently and publicly on the network, which means that anyone can check the balance and transactions concluded by any Bitcoin address.

However, the identity of the owner of the address is unknown until he discloses his personal data when making the transaction or otherwise. This is one of the reasons Bitcoin addresses should only be used once. Always remember that it is your responsibility to use good practices to protect your privacy.

A Bitcoin transaction is usually made within a few seconds and begins to be confirmed within the next 10 minutes. During this time, the transaction can be considered authentic but reversible. Dishonest users can try to cheat.

If you can’t wait for confirmation, security can be increased by applying a small transaction fee or using a double-spending detection system. For larger transactions, for example, worth $ 1,000, it’s worth waiting for 6 or more confirmations. Each confirmation exponentially reduces the risk of a reversed transaction.

The cryptocurrency market is very volatile in its prices

An example is Bitcoin, whose price has varied from a quote of several hundred dollars to over USD 17,000 in 2017. There is no way to determine whether BTC will increase or decrease in the future. There are over 200 different coins on the market whose prices are also unpredictable.

Any investor who feels uncomfortable due to high volatility and risk should consider whether cryptocurrencies are for him.